Case Study:

Thinking beyond the product, & improving the holistic customer experience.

Fidelity Investments is a leader in investment tools and trading platforms, offering investment brokerage and 401k management services to empower customers in their financial journeys.

In addition to designing cutting-edge applications, my product design team proactively sought opportunities to enhance the broader user experience. In this case, we tackled a critical pain point in the hardship withdrawal process, transforming a slow and frustrating ordeal into a swift, reliable solution.

The Challenge

To track down an opportunity to improve our business, I reached out to the Customer Service Rep team managers and requested the transcripts from their toughest 5 support calls that were escalated at least twice before being closed.

With transcripts in hand, my team got to work reading and documenting hours of support calls.

One customer, “Sally,” faced an urgent personal emergency and qualified for a hardship withdrawal from her 401k—funds that should have reached her account in 8 days. Instead, due to inefficiencies in the legacy process, Sally waited over two weeks for her money. Sally's case case stood out as a clear call to action.

Our Approach

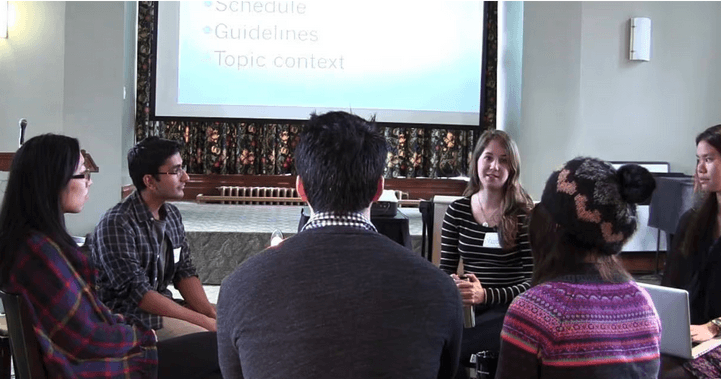

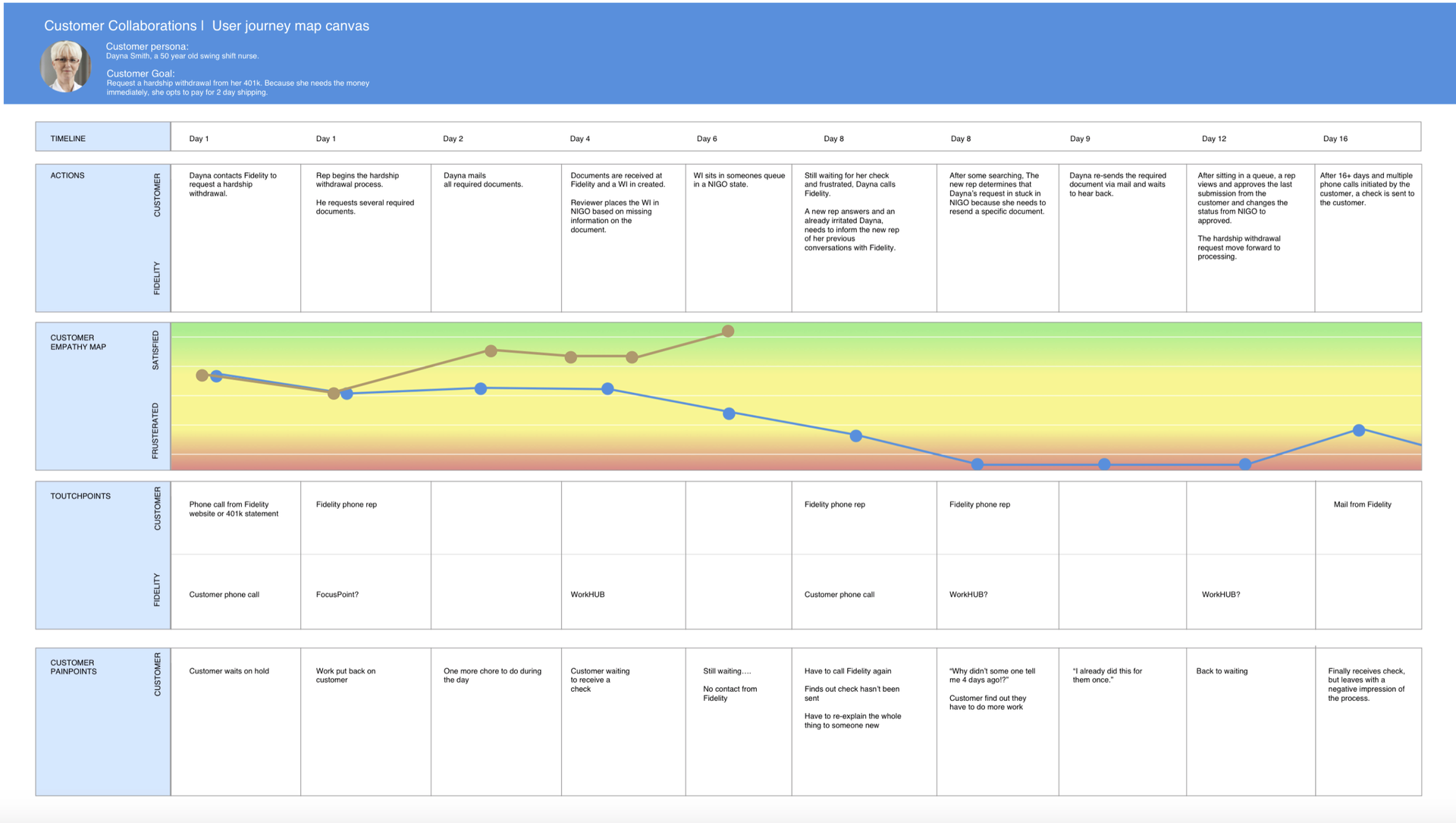

We dug into Sally’s experience, mapping her journey based on the support call transcripts to pinpoint where delays occurred and their root causes.

Key findings included:

1.) Mailing signed documents is slow, cumbersome and error prone.

2.) If the mailed document needs revising it can cause additional delays.

3.) Manager approval requests can become lost in the legacy work queue system.

Journey maps and Empathy maps were created to identify pain point causes and opportunities to improve.

Our Solutions

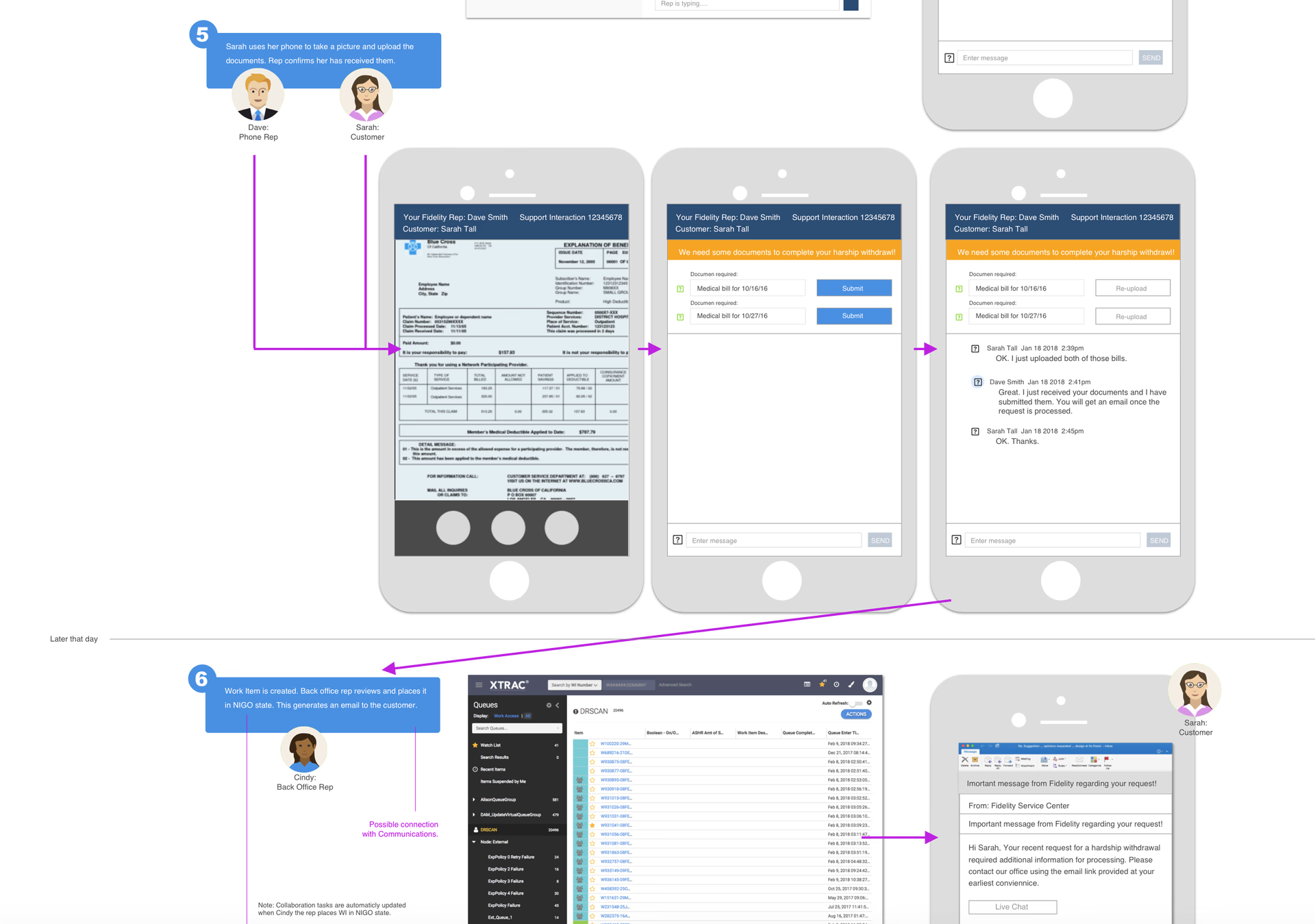

Mobile integration:

Mailing signed documents via registered mail was replaced with SMS text alerts and a link to DocuSign Mobile. Not only did this insure the customer was aware immediately that a document required their signature to move forward, but they could complete the request and return the signed document directly on the phone.

Workflow UI Upgrade:

Pop-up alerts were integrated into the Manager Portal UI to highlight time-sensitive approval requests. This eliminated the need for managers to manually check their alerts queue, ensuring timely approvals and smoother workflow progression.

Real-time SMS updates:

The customer was now updated in real time as each step of there request was completed via text message updates, a progress bar and a direct chat/email link to the CSR handling their request.

Validation:

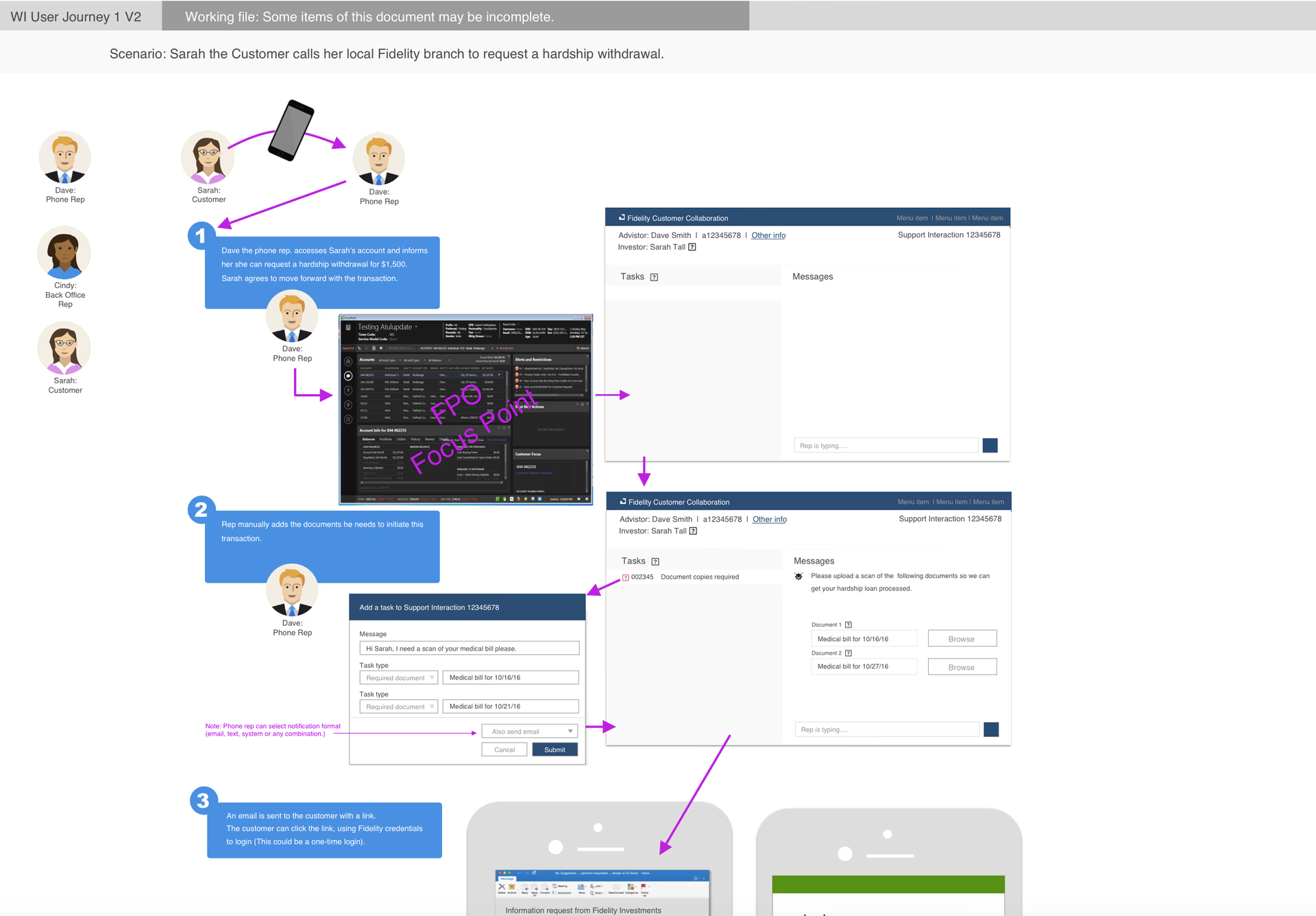

Focus group with customer service reps were conducted to validate our assumptions and refine our solutions.

Collaboration:

We partnered closely with the VP of Investor Relations and VP of Product Design, crafting user journey maps and interactive prototypes to secure joint buy-in for a re-imagined customer withdrawal system.

The project was approved and is currently the backbone of Fidelity's fast, efficient and scalable hardship withdrawal system

The Results

The original process spanned 10 steps, and in this case took 16 days with multiple opportunities for delays—sometimes adding a day each. Our optimized workflow slashed it to 6 steps, guaranteeing funds delivery in 5 days or less by eliminating human bottlenecks.

This effort resulted in a 78% improvement in time-to-deposit, ensuring customers like Sally get critical funds when they need them most.

SUS surveys were used to gauge customer satisfaction of the improved process and a SUS Report similar to this was provided to stakeholders.

Impact

This overhaul not only resolved a glaring inefficiency but also reinforced Fidelity's commitment to user-centered design. By blending user research, cross-team collaboration, and smart technology, we turned a stressful experience into a seamless one—proving that empathy and innovation go hand in hand.

78%

Faster time to deposit

75%

Reduction in support calls

250%

Improved satisfaction rating

The system now powers Fidelity’s hardship withdrawal process—delivering one of the industry’s fastest, most efficient, and scalable solutions to get customers their money when they need it most.